Understanding PayPal Exchange Rates: Your Guide To Smarter Spending In 2024

Moving money around the globe has become a regular thing for many of us, whether we are buying something from another country or sending cash to family. PayPal, as you know, is a very popular way to do this. But, you know, there is one part of using PayPal for international payments that can feel a bit confusing for folks: the exchange rate in PayPal. It is almost like a hidden player in your transactions, yet it really impacts how much money actually lands in someone else's account or how much you pay for that overseas item.

Getting a good handle on how these rates work is pretty important. Just like how having clear, shared health information helps improve patient care and keeps costs down, having clear information about your money's journey through services like PayPal can similarly help you manage your finances with more ease and fewer surprises. It is about making sure you know what is happening with your funds, so you can make choices that save you money, too.

This article will talk about the exchange rate in PayPal, helping you see what it is all about. We will look at how it works, what fees might pop up, and some smart ways to make your money go further when you send it across borders. You will get practical tips and a better idea of how to handle your international payments with more confidence, honestly.

Table of Contents

- What Exactly is the PayPal Exchange Rate?

- How PayPal Sets Its Exchange Rates

- The Conversion Fee: A Separate Charge to Consider

- When Do Exchange Rates Come Into Play on PayPal?

- Checking the Current PayPal Exchange Rate

- Smart Ways to Manage PayPal Exchange Rates

- PayPal vs. Other Options: A Quick Look

- Common Questions About PayPal Currency Conversion

- Making Your Money Smarter

What Exactly is the PayPal Exchange Rate?

The exchange rate in PayPal is basically the value of one currency when you trade it for another. So, for example, it tells you how many US dollars you get for one Euro, or vice versa. When you send money to someone in a different country, or perhaps buy something from an international store, PayPal needs to change your money from your home currency into the currency of the person or business you are paying. This is where the exchange rate steps in, you know.

It is not just a straightforward conversion, though. Financial services, like PayPal, often add a little bit extra to the market rate, which is the rate you see on financial news sites. This added amount is sometimes called a "spread," and it is how they make some money on these currency swaps. So, what you see on a quick online search for "USD to EUR" might be a bit different from what PayPal offers you, actually.

How PayPal Sets Its Exchange Rates

PayPal gets its exchange rates from wholesale currency markets, which are always moving, you know. But then, they add a percentage to that base rate. This percentage is their currency conversion fee, which is rolled into the exchange rate they show you. It is not a separate line item you see, but it is definitely there, making the rate slightly less favorable than the true market rate.

The exact percentage they add can change, depending on the currencies involved and the type of transaction. For instance, sending money to a friend might have a slightly different spread than paying a merchant. This makes it a bit tricky to always know the exact cost without checking at the time of your transaction, which is pretty much why transparency is so helpful, like knowing what to expect with your health records.

The Conversion Fee: A Separate Charge to Consider

It is important to remember that the exchange rate itself includes a built-in fee, but sometimes PayPal also charges a separate "currency conversion fee" on top of that. This usually happens if you choose to have PayPal do the currency conversion when you are paying a merchant in a foreign currency, rather than letting your credit card or bank do it. It is a bit like paying for a service, really.

This fee can vary, but it is typically a percentage of the transaction amount. For example, in mid-2024, it might be around 3% or 4% above the wholesale exchange rate, depending on the currencies. Knowing this distinction can help you make a more informed choice about who does the currency changing for your payment, which is quite useful.

When Do Exchange Rates Come Into Play on PayPal?

The exchange rate in PayPal becomes a factor in a few common situations. First, when you send money to someone in a different country who uses a different currency. Your money gets converted, and the recipient gets the equivalent in their local currency. This is probably the most common scenario for many people, you know.

Second, when you receive money in a foreign currency. If you do not have a balance in that currency, PayPal will typically convert it to your primary currency. Third, when you are buying something from an international seller who lists prices in a currency different from yours. PayPal will offer to convert the payment for you, or you can choose to have your linked card or bank do it. So, it is pretty much involved in any cross-border money movement.

Checking the Current PayPal Exchange Rate

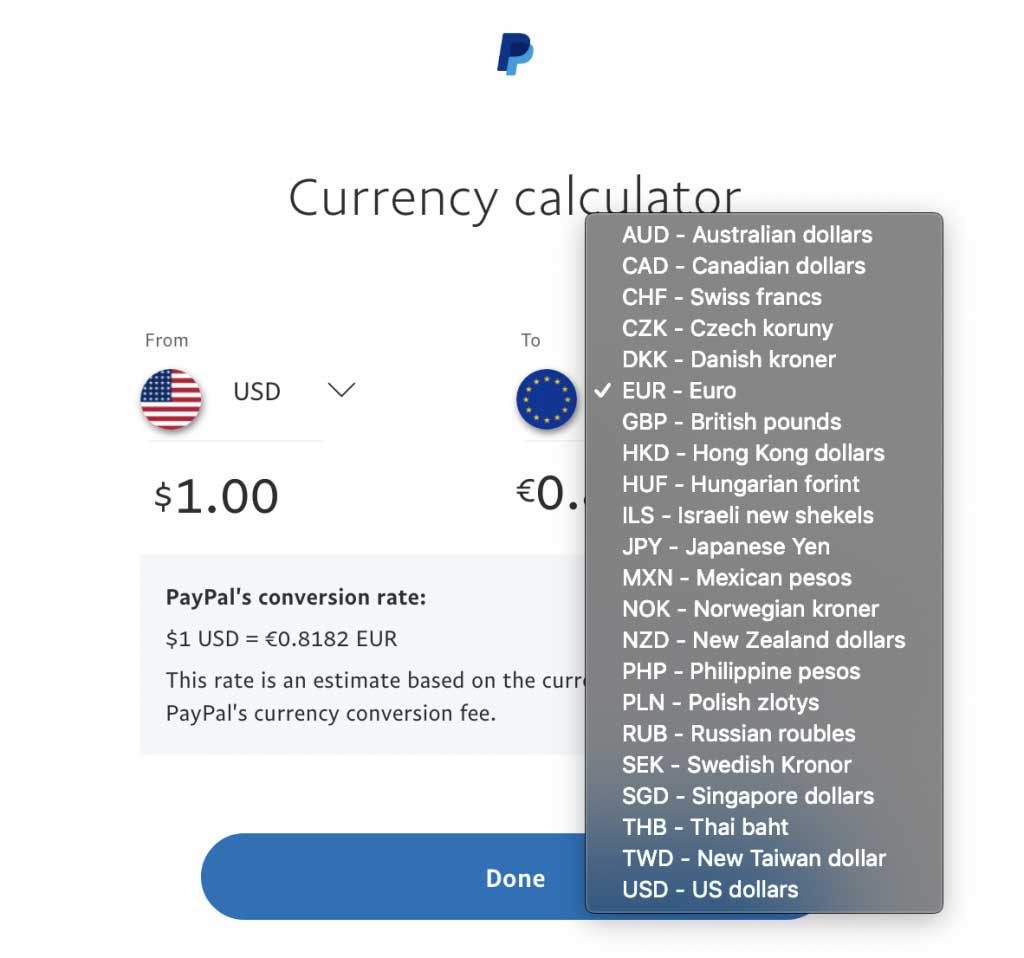

You can actually see the exchange rate PayPal will use before you complete a transaction. When you are sending money or making a payment that involves a currency conversion, PayPal will show you the exact rate they are offering for that specific transaction. This is a very good feature, honestly, because it lets you see the numbers upfront.

To check it, just start the payment process. Enter the amount and the recipient's details. Before you hit "send" or "confirm," you will see a summary that includes the exchange rate applied. This is the moment to look closely and decide if you are okay with the rate. It is like getting a clear picture of your health data before making big decisions, you know, for better outcomes.

Smart Ways to Manage PayPal Exchange Rates

There are some pretty smart ways to try and get a better deal on your currency conversions when using PayPal. Knowing these can really help you save a bit of cash over time, especially if you do a lot of international payments. It is about being a bit savvy with your choices, really.

Pay in Local Currency When Shopping

When you are buying something from an international website and checking out with PayPal, you might see an option to pay in your home currency or the seller's local currency. PayPal often defaults to converting the payment for you, showing you the price in your home currency. However, you can usually change this option. If you select to pay in the seller's local currency, your linked credit card or bank will handle the conversion instead of PayPal.

Your credit card or bank might offer a more favorable exchange rate than PayPal, especially if your card has low or no foreign transaction fees. It is worth checking your card's terms beforehand, but this can often be a very good way to save a little bit. So, it is a choice you get to make, which is pretty cool.

Use Your Bank for Conversion

Similar to the point above, when you are sending money from your PayPal balance, if you have funds in your home currency, PayPal will convert it. But if you have a bank account linked, sometimes your bank's exchange rate might be better. This is not always an option for every transaction type, but it is something to keep in mind, you know.

For some payments, you can actually choose to fund the payment directly from your bank account in the foreign currency, if your bank allows it and offers a better rate. This requires a bit of research on your part to compare rates, but it could definitely be worth the effort for larger amounts. It is all about finding the most cost-effective path, basically.

Hold Multiple Currencies in Your PayPal Balance

If you regularly receive payments in foreign currencies, you can actually hold balances in those currencies within your PayPal account. This means if someone sends you Euros, you can keep them as Euros instead of immediately converting them to your home currency. Then, when you need to send Euros to someone else, or perhaps buy something priced in Euros, you can use your Euro balance directly, avoiding a conversion fee entirely.

This is a very effective strategy for freelancers or businesses that deal with international clients frequently. It gives you more control over when you convert your money, allowing you to wait for a more favorable exchange rate if you wish. It is like having different pockets for different types of money, which is quite handy.

PayPal vs. Other Options: A Quick Look

When it comes to exchange rates, PayPal is generally convenient, but it is not always the cheapest option. Traditional banks can sometimes have higher fees or less competitive rates for international transfers, but not always. Some specialized money transfer services, like Wise (formerly TransferWise) or Remitly, often offer closer to the mid-market rate with transparent fees, which can be very appealing for larger transfers.

The choice really depends on what matters most to you: speed, convenience, or cost. For smaller, occasional payments, PayPal's ease of use might outweigh the slight difference in exchange rates. For bigger sums, or if you send money often, it definitely pays to shop around and compare the total cost, including all fees and the exchange rate spread. It is pretty much like comparing different ways to manage information, you know, to find the best fit.

Common Questions About PayPal Currency Conversion

How does PayPal determine its exchange rate?

PayPal gets its base exchange rate from the wholesale currency markets, which are always changing. Then, they add a percentage to that rate, which is their currency conversion fee. This means the rate you see includes their charge, making it a bit different from the pure market rate you might find elsewhere. So, it is a combination of the market rate and their service charge, basically.

Can I avoid PayPal's currency conversion fee?

Yes, in some situations, you can. When you are paying a merchant, you can often choose to have your linked credit card or bank handle the currency conversion instead of PayPal. This can sometimes result in a better rate if your card or bank has lower foreign transaction fees. Also, if you hold the foreign currency in your PayPal balance, you avoid conversion fees when spending that specific currency, which is pretty neat.

Is PayPal's exchange rate better than my bank's?

It really depends on your specific bank and the type of transaction. Sometimes, PayPal's rate might be better, and other times, your bank's might be. Many banks also add their own fees and spreads to international transfers. The best way to know for sure is to compare the exact rates and fees at the time of your transaction. It is always a good idea to check both options if you can, you know, just to be certain.

Making Your Money Smarter

Understanding the exchange rate in PayPal is a pretty big step towards being more in control of your international payments. Just as we strive for clear and secure ways to share health information for better care and managing costs, having clear information about your financial transactions helps you make better decisions. You know, it is about transparency and making sure you get the most value from your money. By knowing how PayPal's rates work and using some smart strategies, you can potentially save a good amount of money over time.

So, next time you are sending money or buying something overseas with PayPal, take a moment to look at the exchange rate offered. Consider if letting your bank handle the conversion or holding foreign currency might be a better option for you. Every little bit saved can add up, and that is pretty much a good thing for your wallet. For more information on international payments, you could check out resources like XE.com's currency converter, which is a good place to start comparing market rates. Learn more about on our site, and link to this page for more helpful tips.

5 PayPal Scams to Watch Out For

PayPal launches new cryptocurrency platform

PayPal USD to IDR Exchange Rates Compared Live | BestExchangeRates